Commercial tenants in the Hornsby electorate significantly impacted by COVID-19 will have greater protection from evictions with the State Government set to enact the National Cabinet Code of Conduct as part of a $440 million land tax relief package.

Member for Hornsby Matt Kean MP said the measures will apply to commercial leases where the tenant is in financial distress due to COVID-19, including but not be limited to local shops, cafes, gyms, hairdressers, restaurants, offices, warehouses and industrial sites.

The land tax relief will be divided approximately 50-50 with around $220 million going to the residential sector and a further $220 million to the commercial sector.

Commercial landlords will be offered the land tax concession if they pass the savings on to tenants through a rent reduction.

Eligible landlords will be able to apply for a land tax concession of up to 25 per cent of their 2020 (calendar year) land tax liability on relevant properties. A further land tax deferral for any outstanding amounts for a three-month period will also be offered to landlords who claim the land tax concession.

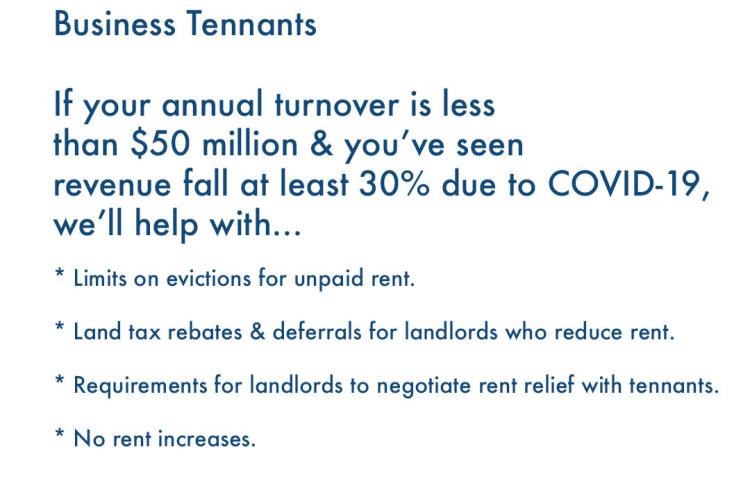

The Government will give effect to the Code of Conduct, which will operate for a temporary period during the pandemic, and include the following key measures:

- Landlords must negotiate rent relief agreements with tenants in financial distress due to COVID-19 by applying the leasing principles in the Code;

- A ban on the termination of a lease for non-payment of rent;

- A freeze in rent increases.

To facilitate these changes, and deliver increased mediation and advisory services to commercial parties, the NSW Small Business Commission will be bolstered with extra staff and an injection of $10 million from the $1 billion Working for NSW Fund.

The policy will apply to business tenants with a turnover of less than $50 million that experience a 30 per cent (or more) reduction in revenue as a result of the COVID-19 pandemic, in line with the Prime Minister’s announcement on 7 April.

This will include any business with annual turnover of less than $50 million who is eligible for the Commonwealth’s Job Keeper program.

Treasurer Dominic Perrottet welcomed the initiatives, saying they would help businesses stay afloat and provide greater surety for tenants and landlords.

“This provides a way forward for tenants and landlords so they can reach an agreement during this difficult period and includes an incentive in the form of a land tax reduction.” Mr Perrottet said.

Finance and Small Business Minister Damien Tudehope said the package demonstrated the need for a united effort to endure the COVID-19 pandemic.

“Breathing room on rent is one of the most frequently raised issues by businesses, and we want to ensure we protect retailers and offer landlords an incentive to do so. We also want to ensure retail tenants have more time and options,” Mr Tudehope said.

“For any small business rent is one of the biggest fixed costs, easing this burden will help operators survive and keep people employed, and that is what this new package is all about,” Mr Kean said.